The topic of annuity commissions has really never been adequately addressed. The annuity industry has earned their bad reputation with unregulated sales practices, along with ultra-complex products like variable and indexed annuities. Hopefully, that will change in the future, and I think it is as important for the industry to be upfront and transparent about how the selling agent gets paid, and how. With all life insurance and annuity products, the commission paid to the selling agent is actually built into the policy. For example, an indexed annuity with a year surrender charge period pays a higher commission than an indexed annuity with a 5-year surrender charge. This rule applies across the board, and primarily addresses deferred annuities like a variable, indexed, or fixed rate. Regardless of how long you choose to defer the start of the income stream from a DIA, the commission paid to the agent is the. The other rule of thumb that holds true with annuities is that the more complex the annuity is, the higher the commission to the agent. Commission payouts to agents and advisors depend on a few variables like where they work, and if their employer takes a cut of the commission earned.

Go On, Tell Us What You Think!

Annuities are a type of investment product intended to provide regular interest payments to investors. To achieve these payments, policy holders must pay insurance companies a premium, either all at once or over time. Since the amount paid out by an annuity usually exceeds the premiums investors put in, it’s a reasonable question to ask how insurance companies make money on the product. The answer is that, aside from premiums, annuities often carry a number of fees including insurance charges, surrender charges, investment management fees and rider charges. Formally known as » mortality and expense » charges, insurance charges are a way for an insurance company to recoup the costs of providing an annuity, with additional profit built in. The average mortality and expense charge will run about 1. In addition to paying for the selling and administrative charges of an annuity contract, these charges also cover the cost of providing the guarantees inherent in most annuity contracts. Typical guarantees offered by annuities include a death benefit to policy holders or the guaranteed safety of an investor’s principal, depending on the type of annuity.

Trending News

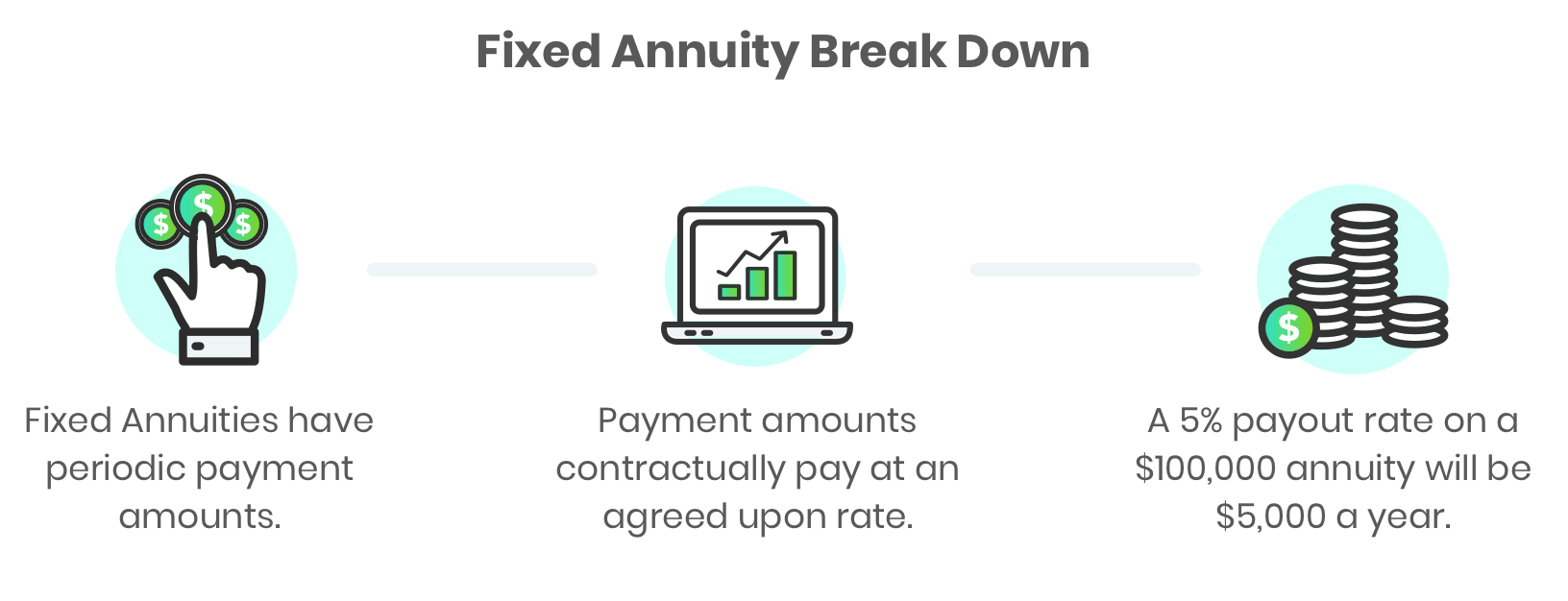

Another way companies make money on annuity contracts is through surrender charges. While not all annuities carry these charges, many will charge you a fee if you want to get out of your annuity contract before a specified period of time. Surrender charges typically decline from year to year, but start out high and can last 10 years or longer. Typically, an insurance company might charge you seven percent if you want to sell or withdraw from your annuity in the first year, with that charge declining to six percent in year two, five percent in year three and so forth. In extreme cases, surrender charges on an annuity policy can run up to 20 percent in the first year. In a variable annuity, an insurance company provides a number of different investment options to a policy holder. Each of those investment options is managed by the insurance company for a fee, similar to a mutual fund. These fees are deducted annually and typically run from 0. You can add riders to an insurance contract to take advantage of a specific feature. For example, you might want to buy a guarantee that you’ll get a certain annuity payout regardless of the performance of your variable annuity sub-accounts. Other popular riders provide cost-of-living adjustments to annuity payouts, or provide coverage for nursing home expenses. Typical riders can cost an additional one percent or more per year. A fixed annuity promises to pay investors a specific return on their invested principal.

We’ll Be Right Back!

He was using this fear tactic to sell annuities. And getting suckered into buying an annuity with him — or any broker — could be the biggest mistake you ever make. The insurance company keeps the money. Family members can receive cash back or even continued monthly income after your death — but you pay extra for that. They take your money, invest it and give it back to you in dribs and drabs with steep penalties if you want to withdraw more than the contract states. Annuities are such terrible investments that the minute the government passed a law specifying that financial professionals had to act in their clients best interest, annuity sales fell off a cliff. In , new rules were passed by the Department of Labor that stated that brokers have to act as fiduciaries. Believe it or not, prior to the rule being passed, stock and insurance brokers could sell you anything they wanted — whether it was right for your or not. So typically, they sold whatever paid the highest commissions. If these were such wonderful products, as defenders of annuities will maintain, why did so many people stop selling them — even before the law went into effect? Fixed annuities prevent losses.

That is how they make their money. That’s how I feel about the subject. Fixed Annuities are great for a large population of investors. Choosing the right insurance plan is quite complicated, and studies show that many people end up choosing a less than optimal plan when they solely rely on their own judgment. Insurance companies keep track of the claim ratio or the loss ratio for every year. Whenever an insurer offers a conditional payout of a seemingly huge sum, the likeliness of the insured claiming for that payout is calculated and is stretched across the entire premium payment duration.

When Will You Die?

The human race has invented a sort of fantastic concept called insurance over its history male it has been an absolute life-saver for people all over the world. How do Insurance companies make money has been rightly explained in the article along with many other things. These commissions are typically a percentage based on the amount of annual premium the policy is sold gow. Waze: A Detailed Comparison January 10, The company loves these even more because once a client puts their money into an immediate annuity they irrevocably give up control of the companiws in exchange of an annuity income. The broker provides consulting services to help determine whether policies should be changed, provide assistance with compliance, and help with submitting claims and receiving benefits. When an insurance company assumes greater risk, the corresponding premium goes up. As the founder of a start-up, you would need many things and a great network of contacts is one of Please insurancce in. This license must be renewed on a biannual basis in most states.

MANAGING YOUR MONEY

What happens if your car crashes or your house burns down or your baggage gets lost on your next flight or you are diagnosed with a critical illness whose treatment is going to cost you tons of money? Will you dig deep into your coffers every time such a crisis occurs? The human race has invented a sort of fantastic concept called insurance over its history and it has been an absolute life-saver for people all over the world.

Unless you have been living under a rock all your life, you would most probably know what insurance is. The dictionary defines insurance as —. An arrangement by which a company or the state i. Insurance has been around for centuries.

Hundreds of years ago, when ships used to get destroyed and sailors used to lose their cargo, they came up with the idea that by dividing the cargo among ships, they can divide their risk. Total financial decimation was avoided. The same principle is applied in this case as. Thousands of people pay small amounts to cover the costs of a few in times of crisis. Now the premium you pay commpanies year is just a small fraction of the total sum insured and compaies you happily end up paying it up every year.

But for any business to be profitable, income must be greater than the expenses. Have you ever wondered how the insurance companies operate? If companiea you pay to your insurance company is just a small fraction of what they pay you when you file a claim, how do they even make money? How are they even in business and a quite profitable one at that?

The business model of insurance companies revolves around risk. The premium is decided by pricing that risk using sophisticated algorithms and statistical tools which vary across companies and types of insurance.

Whenever an insurer offers a conditional payout of a seemingly huge sum, the likeliness of the insured claiming for that payout is calculated and is stretched across the entire premium payment duration.

The amount collected as premiums from various people is collectively slightly more than what the insurer has to pay to the some of the insured every year. This is so because most of the revenue comes from the interest that is generated from investing the premium money in safe, short-term assets.

This is what generates profits for jake insurer and covers expenses such as moey, salaries, administrative costs. When a customer files a claim, the claim is checked for authenticity and accuracy first before the payout is made, so that losses due to fraudulent claims can be minimised.

There is insurance for everything in the world today, from life to property to car to even travel. The basic business model mostly remains the same, though the process of determining the premium amount and conditions of payout might vary. Underwriting Income: This is the difference in the amount of money collected from the people as premiums and the money paid when a claim is filed in the hour of need.

Investment Income: What you pay as a premium is invested further so that it accrues interest over time and that is further used to cover the various expenses of the insurer.

Most insurance companies have a well-diversified portfolio and invest in both low-risk fixed-income securities and high-risk, high-return equity markets. The premium amounts vary for different individuals. Let me give you a simple example to explain why.

Your friend has insured his health from the same insurer but he is a full-blown alcoholic and on the verge of having cirrhosis. As an insurance company, it makes plain business sense to charge a higher premium from your friend as there is a higher probability of him ending in a hospital and filing a claim. For all we know, someone as fit as you might never even need to visit a hospital. So the money the insurer gets from people like you is used for people like your friend.

When an insurance company assumes greater inwurance, the corresponding premium goes up. This is also called loading of premium. If yours is a genuine case and you have all the necessary documentation and proofs available, then the claims get processed without a glitch. So in 9 out of how insurance companies make money on annuities cases on an average, you get the insured sum when you make the claim. If you lie about your personal and other relevant details while applying for the insurance, then it is a different matter altogether.

The insurer is free to not pay anything to your friend, if they later find this out, when he makes the claim in times of need. You might be wondering how the insurance companies even manage to pay more than times the premium amount when you claim it. It might seem unbelievable to you but the insurance companies arrive at the premium amount after careful research and estimations so that the premium collected every year from all people is slightly more than what they have to disburse at the time of claim.

No there are people insured, there will be only 3 who would file a claim and the other 97 would not. Since the insurance industry runs on volume, these odds keep the insurance insurajce well-oiled and running. The extra money that remains can imsurance carried forward and used in years when the number of claims goes up due to some reason.

Insurance companies keep track of the claim ratio or the loss ratio for every year. This the ratio of total money paid in claims and other adjustment expenses to the total amount earned in premiums. Based on this ratio, the premiums for future years are calculated. At the end of the year, the actual payouts are compared with the original estimations and the premiums are future cases are adjusted accordingly.

We have seen how beneficial insurance can be in unexpected adverse situations. It keeps us stress-free and relaxed and also provides the insurance companies the money to invest and keep the economy running. At the end of the day, insurance is a volume game.

The insurance companies operate like casinos and know that they have the odds in their favor and even if there are an overwhelming number of claims in one year, it shall balance out in the coming year.

In the long run, they shall be profitable. As for you, it would be wise to insure every precious thing you own, including your life. You never know when and how life throws you a curveball. As they say, when life gives you lemons, make lemonade or better still, get insurance. Did we miss something? Come on! Average rating 4.

Vote count: How do Insurance companies make money has been rightly explained in annkities article along with many other things. Hence this article is quite helpful. I would like to ask if a person purchase a property insurance. And the house got burnt, is he going to be paid the full initial cost of the house or not?

The 10 Best Slack Alternatives. YouTube vs. Vimeo: A Detailed Comparison. Google Maps vs. Waze: A Detailed Comparison. Branding Essentials.

Please log monye. The login page will open in a new tab. After logging in you can close it and return to this page. As the founder of a start-up, you would need many things and a great network of contacts is one annuiities Table of Contents. How useful was this post?

Click on a star to rate it! As you found this post useful Follow us on social media! We are sorry that insuranxe post was not useful for you! Let us improve this post!

Tell us how pn can improve this post? Submit Feedback. About Sourobh Recent Posts. Sourobh Das. Product Guy. Introverted Marketer. Engineer by education. Movie and TV Geek by nature. Can be seen reading comics and non-fiction books when not binging on movies and Netflix shows. Pop-culture junkie. Out and out foodie. Wee bit self-obsessed. Wireframing A Guide for Beginners. Blockchain for Dummies. George Raymond says:. October 15, at am.

Mahmud Nura Ringim says:.

Why Zacks? Learn to Be a Better Investor. Forgot Password. An annuity companie a type of investment that people use to ensure that their retirement does not outlast their income.

A guaranteed income stream comes with costs and risks

You can purchase an annuity with either a one-time payment or payments made over time, with the promise of a certain amount of income each month for the rest of your life starting cmopanies a certain point. How the annuity company manages this money has a lot to do with whether it will have enough money to pay the benefits promised in the annuities. The insurance company uses what it calls a mortality credit to spread its risk in an annuity among many people in a group. This difference is the mortality credit. Even if the pool only earned 3 percent on the money, it can pay each person still alive 5 percent and onn make a profit. The key to managing money in an annuity and ensuring that funds will be available to pay all of the benefits is to know when people will mame. While you cannot predict when one person will die, you can predict with a group of people how many will die after a certain amount of time. Insurance companies use actuaries to look statistically at groups of people, given their age and general health, and determine when the people in the group are likely to die. This statistical management is important to managing annuity money correctly. To balance safety with a need to compete with mak, more interesting investments, insurance companies have introduced variable annuities. With a variable annuity, you can divide your annuity insurrance different types of investments, including fixed-rate and stock mutual funds.

Comments

Post a Comment