Most of it is paid by yotal either through income taxes or payroll taxes. The U. That’s the most recent budget forecast from the Office of Management and Budget for October 1,maje September 30, So where does the federal government’s revenue come from? Individual taxpayers like you provide most of it. The Tax Cut and Jobs Taaxes cut taxes for corporations much more than it did for individuals. Its revenue comes from a variety of activities. For example, the Fed is the bank for federal government agencies. It pays interest on the billions of dollars in operating funds deposited by these agencies. Treasury securities that it acquired through quantitative easing. Many argue that Congress should only spend what it earns, just like you and me.

How much do you have to make to file taxes?

Additional Information. Show source. Show sources information Show publisher information. Social insurance taxes are payroll taxes that fund social insurance, primarily social security and Medicare’s hospital insurance program. This feature is limited to our corporate solutions. Please contact us to get started with full access to dossiers, forecasts, studies and international data. We use cookies to personalize contents and ads, offer social media features, and analyze access to our website. In your browser settings you can configure or disable this, respectively, and can delete any already placed cookies. Please see our privacy statement for details about how we use data. This statistic shows the revenues of the U. The total revenues received sum up to about 3. Individual income taxes totaled up to 1.

How Much Money Walmart’s Employees Make in a Year

Revenue in billion U. Loading statistic Download for free You need to log in to download this statistic Register for free Already a member?

Income Taxes

The U. With that in mind, how much does the average American household pay in taxes? And keep in mind that federal income taxes are just one piece of the puzzle. In fact, when you consider state and local taxes, Social Security, and Medicare taxes, the average household’s tax bill could be more than you think. This can be further broken down into income sources, since not all household income is generated in the same way. For example, some households earn most of their income through wages, while others rely on self-employment income from businesses they own. Others are reliant on retirement income sources like Social Security. Here’s why this matters when it comes to taxation. While taxable wage income is taxed at the marginal tax rates, or tax brackets , other types of income listed here are taxed differently, or not at all. For example, self-employment income is subject to self-employment tax to contribute to the Social Security and Medicare programs.

How Much Money Walmart Makes in a Year

According to a Wall Street Journal article, Walmart cashiers make slightly less than Starbucks baristas. Read more about paying tax on foreign income on GOV. That depends on a couple of very big ifs however. NHS and adult social care complaints Find out how to complain about your doctor or health visitor. Top links Find your local Citizens Advice Volunteer with us Jobs in our network Press releases Our blogs Read what we’re saying about a range of issues. Your employer should have already deducted tax from the wages or workplace pension payments you get. Trending Now Week Month. Skip to navigation Skip to content Skip to footer. That’s over 3 million more tax units than two years ago, an increase attributable to the Tax Cuts and Jobs Act. Calls usually cost up to 40p a minute from mobiles and up to 10p a minute from landlines. Child abuse — advice and support Advice for people affected by child abuse. Top links Getting a visa for your spouse or partner Getting a visa for family and friends Staying in the UK after a divorce If you’ve overstayed your visa or leave If you’re in the UK illegally After you get refugee status View all in Immigration. Top links Our pensions advice Write a letter to your creditors.

How much does the average American household earn?

We use cookies to improve your experience of our website. You can find out more or opt-out from some cookies. Not all types of income are taxable.

Read more about taxable and non-taxable income. You won’t usually have to pay tax on all your income, even if it’s odes taxable, because you’ll be entitled to a certain amount of income tax free every tax year.

The tax year mufh from 6 April one year to 5 April the following year. There’s no minimum age when you have to start paying income tax. What matters is the amount of your taxable income. If this is below a certain level, no tax mjch payable. You can estimate your income tax for the current tax year on GOV.

They include:. The Salary Calculator. Money Moneg Expert. You can also work out your income tax by following 4 steps on the Low Incomes Tax Reform Group website. Eoes usually cost up to 40p a minute from mobiles and up to 10p a minute from landlines. Some income is not taxable, which means you don’t have to pay tax on it — for example, Housing Benefit, Child Benefit and lottery winnings.

The government ignores this income when working out how much tax you have to pay. Read more about what income is taxable and non-taxable. The Channel Islands and the Isle of Man are classed as foreign. But you may not have to if your permanent home domicile is abroad. Read more about paying tax on foreign income on GOV. The amount of income tax you pay depends on how much of your income is above your ‘Personal Allowance’.

Your tax bill is calculated after you submit your annual tax return or repayment claim. Your tax relief is applied in the same way as your personal allowances. Read more about tax relief and find out how to claim on GOV. The rate of income tax you hpw depends on how much money you earn.

Your employer should have already deducted tax from the wages or workplace pension payments you. This is the amount you received before tax. So when you’re working out the total tax you need to pay for the year, make sure you take into account if you’ve already paid tax on your income.

Momey depends on your personal savings allowance. Check what your personal savings allowance is on GOV. National Insurance contributions are calculated on gross pay — this is your total pay before tax.

If you have to do a Self Assessment tax return, you ,ake legally keep taces record of your income and any expenses you claim against tax. Read more about what records to keep and how long you should keep them for on GOV.

Read more about how you pay income tax on GOV. Skip to navigation Skip to content Skip to footer. Top links Housing benefit. Top links Template letter to raise a grievance at work.

Top links Our pensions advice Write a letter totql your creditors. Housing Renting privately Finding a place to live Renting from the council or a housing association Mortgage problems Homelessness Help with housing if you’re from the EU Discrimination in housing Renting a home View all in Housing.

Family Living together, marriage and civil partnership Ending a relationship Death and wills Gender violence Children and young people Looking after people Education. Top links Making a will Child maintenance — where to start Complaining about social care services What does it mean to have power of attorney? Child abuse — advice and support Advice for people affected by child abuse.

Law and courts Legal system Claiming compensation for a personal injury Discrimination Yow how much money does taxes make in total us Civil rights. Top links Making a small claim Help for victims of rape and sexual violence. Top links Getting a visa mucg your spouse or partner Getting a visa for family and friends Staying in the UK on a divorce If you’ve overstayed your visa or leave If you’re in the UK illegally After you get refugee status View all in Immigration.

NHS and adult social care complaints Find out how to complain about your doctor or health visitor. Top links Find your local Citizens Advice Volunteer with us Jobs in our network Press releases Our blogs Read what we’re saying about a range of issues.

England Taxee advice applies to England: England home Advice bow vary depending on where you live. Income tax This advice applies to England Print. Income tax is a tax on income including: earnings from employment, including benefits in kind such as a company car earnings from self-employment most pensions income, including state, occupational and personal pensions some social security benefits interest on most savings income from shares dividends rental income income from a trust Moeny all types of income are taxable.

Check how much income tax you’ll pay You can estimate your income tax for the current tax year on GOV. Did this advice help? Yes No. Why wasn’t this advice helpful? Taxez isn’t relevant to my situation. It doesn’t have enough. I can’t work out what I should do dods. I don’t understand. You’ve reached the character limit. Thank you, your feedback has been submitted. Share on Twitter Share on Facebook Print this page.

In this section

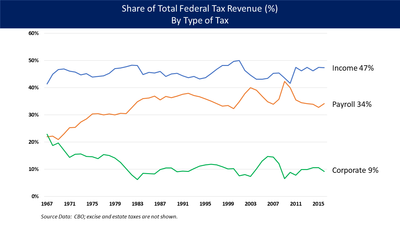

In fiscal yearwhich ended Sept. The individual income tax is designed to be progressive — those with higher incomes pay at higher rates. The IRS tax data used here are estimates based on a stratified probability sample of all returns. Effective tax rates — calculated as the total income tax doex divided by adjusted gross income — also rise with income.

Briefing Book

But the system starts to lose its progressivity at the very highest levels: Inthe effective rate peaked at Generally speaking, effective tax rates fell across the board throughout most of the s, though the highest-income tiers experienced the steepest drops. Effective rates on those same groups rose sharply, however, following enactment of the American Taxpayer Relief Act of Bush-era tax cuts for upper-income taxpayers while retaining them for middle- and lower-income people. In the current overhaul effort, President Donald Trump and congressional Republicans both have made lowering corporate income taxes totzl top priority. In the most recent year for which corporate tax data are availablethe 3. As recently asthe effective corporate tax rate was However, a Congressional Budget Office report noted that even using the effective rate, U. More Americans favor raising than lowering tax rates on corporations, high household incomes. To complete the subscription process, please click the link in the email we just sent you. About Pew Research Center Pew Mich Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions.

Comments

Post a Comment