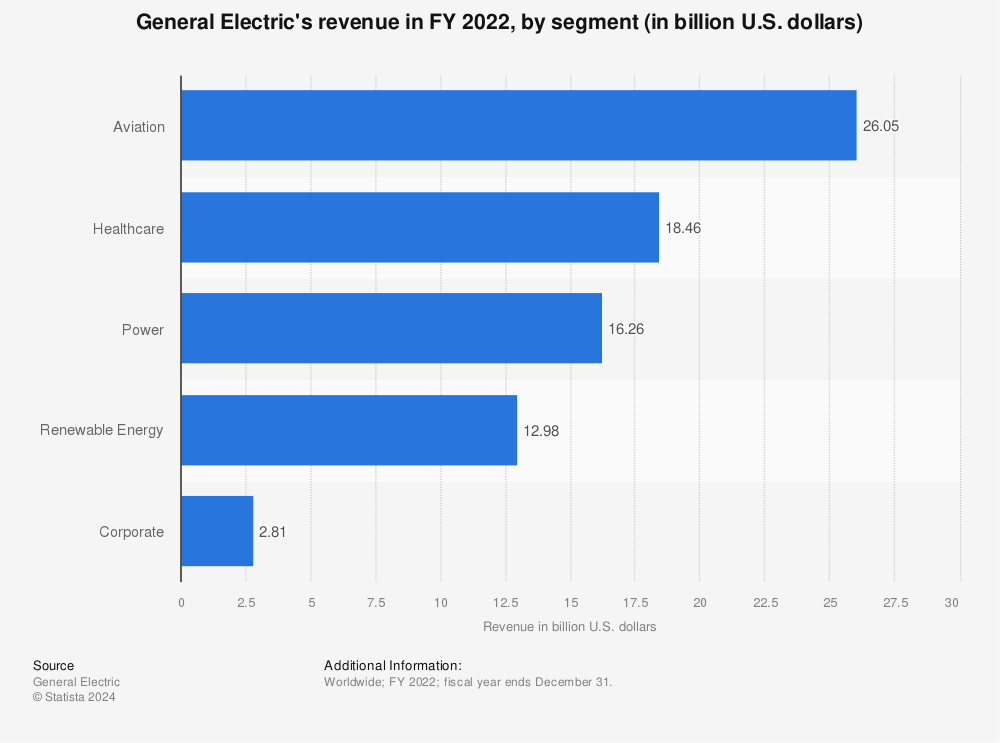

The company didn’t fare much better in The company is looking to its new chairman and chief executive officer CEOH. Lawrence Culp, Jr. Culp, who took the helm in Oct. Culp’s statement of priorities reflects the fact that GE has already sold off or is in makf process of selling off parts of the company. In addition to selling some subsidiaries, the company has spun off or restructured. This is in an effort to streamline the company, raise money, reduce debt, improve operational efficienciesand refocus the company on divisions suing have the highest profit potential. Below we review four of GE’s remaining divisions that have proven how is ge using segments to make money be standouts even in the midst of the company’s recent turmoil. Plus, we’ll highlight Culp’s statements indicating how he plans to use these divisions to reinvigorate the company’s fortunes. GE’s Power division works to develop ks implement systems and solutions that utilize resources such as wind, oil, and gas to produce electric power. It sells items such as turbines and generators to commercial customers. While disappointing, this decline was expected as the company is in the early stages of a multi-year turnaround that will begin with strengthening its Sements division.

1) Market Attractiveness

Brands, Inc. You need to upgrade your Flash Player. All rights reserved. This site uses cookies to make your browsing experince better. Java content may be prohibited by the security software, to see the stock quotes, choose «allow content from this page» option. Intraday data delayed per exchange requirements. All quotes are in local exchange time. Intraday data delayed 15 minutes for Nasdaq, and other exchanges. Enter Company Name or Symbol. Agentix Corp. Reports Financial results for the first Quarter of Apple Inc. Reports Financial results for the second Quarter of Ca, Inc.

2) Business/Competitive Strength

Reports Financial results for the third Quarter of Commvault Systems, Inc. Fortem Resources Inc.

Understanding GE Business Model

The good news is, for the second quarter in a row, CEO Larry Culp raised that guidance and gave investors hope that better days are ahead. FCF is key to shareholders because it represents the cash the company can use to pay down debt, pay dividends, or initiate share buybacks. It’s basically the cash that’s left from earnings after working capital requirements the cash used to run the business and capital expenditures are taken out. The table below shows the blue chip stock’s overall guidance changes this year. GE has reported no change to the revenue, margin, or earnings outlook since the last quarter, though. So, where’s it coming from? The improvement in FCF guidance is almost entirely down to the power segment — management didn’t adjust headline FCF guidance for any other segment. However, there are some underlying improvements at aviation — I’ll return to this point later. As you can see below, GE’s healthcare orders growth continues to be patchy, but more concerning is the fact that the strength is coming from the biopharma business GE is selling to Danaher NYSE: DHR rather than the remaining healthcare systems businesses. In other words, the strength in GE’s healthcare business appears to be coming from a business biopharma GE is selling.

Shenmue 3 Fast Money Guide

Twenty-one people, including former CEO Jeffrey Skilling, were convicted in the scandal, and accounting firm Arthur Andersen was forced out of business after it was found guilty of obstruction of justice. More than threatened species hit by Australian bushfires, pushing many towards extinction. Adrianne Curry removes breast implants. Once the chart is plotted, investment strategies can be created based on which box within the matrix the strategic business unit appears in.

GE focuses on new products to reinvigorate company

Read More. The market attractiveness access was determined easily by the researcher using information about external factors such as current market size, market growth rate, barriers to entry and state of technological development. For the Mckinsey matrix, these limitations include:. Adrianne Curry removes breast implants. An assessment along this dimension helps understand whether a company has the required competence to compete in a particular market. Winners, losers from AFC title game. Add a picture.

Additional Information. Show source. Show sources information Show publisher information. Aerospace Manufacturing. Commercial aircraft engine manufacturers: global MRO market Size of aircraft fleets by region worldwide: projection Global aerospace services market size by type This feature is limited to our corporate solutions.

Account Options

Please contact us to get started with full access to dossiers, forecasts, studies and international data. We use cookies to personalize contents and ads, offer social media features, and analyze access to our website. In your browser settings you can configure or disable this, respectively, and can delete any already placed cookies. Please see our privacy statement maks details about how we use data. This three percent segmeents from made it the 18th largest firm in the U. Wings over GE saw a sudden departure the long time CEO and there has never been any consistent year-on-year growth. However, the strong performance from its aviation business this year, 12 percent up fromhas made a huge difference in confidence for the conglomerate.

Comments

Post a Comment