By Douglas A. McIntyre November 6, am Last updated: January 6, am. Robinhood, a brokerage firm that allows people to trade without commissions, is another unicorn likely to take a large fall. Its management seems so lax that the company has run into serious trouble. This started with a major fault when it introduced a free checking account product. However, they are an example of the carelessness that should concern its venture investors. Among the hurdles Robinhood faces is skepticism about what rapidly growing companies are worth. Among primary recent examples are Uber and WeWork.

Brokerage takes sizable rebates for directing clients’ orders, offsetting for some investors the benefit of zero commissions

Blain Reinkensmeyer January 17th, However, today, all of the largest online brokers offer free stock and ETF trades. As a result, it is much more difficult for Robinhood to outduel the competition. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on Robinhood:. How Robinhood makes money: Facebook FB is a free service. To offset not charging a subscription fee, it generates revenue from collecting your user data and selling ads. In Robinhood’s case, it too is a free service. Instead of selling ads though, Robinhood is selling your order flow the right to fill your order to wholesale market makers. Thus, Robinhood is not really free. Robinhood Gold: In our testing, we found Robinhood Gold to be a bad deal. Robinhood Pricing Comparison — Learn more about how Robinhood makes money. Robinhood offers stocks including fractional shares , ETFs, options, and cryptocurrency trading. Most online brokerages, with the exception being TradeStation , also do not offer cryptocurrency trading.

Most Popular Videos

However, mutual funds and bonds are not supported, nor is futures trading. Cash management : With Robinhood Cash Management, any uninvested cash sitting in your brokerage account earns interest. The total yield is comparable to what you might find in a high-yield savings account, and it fluctuates alongside interest rates.

Compare Robinhood

.

Compare Robinhood Competitors

.

Robinhood’s Mission

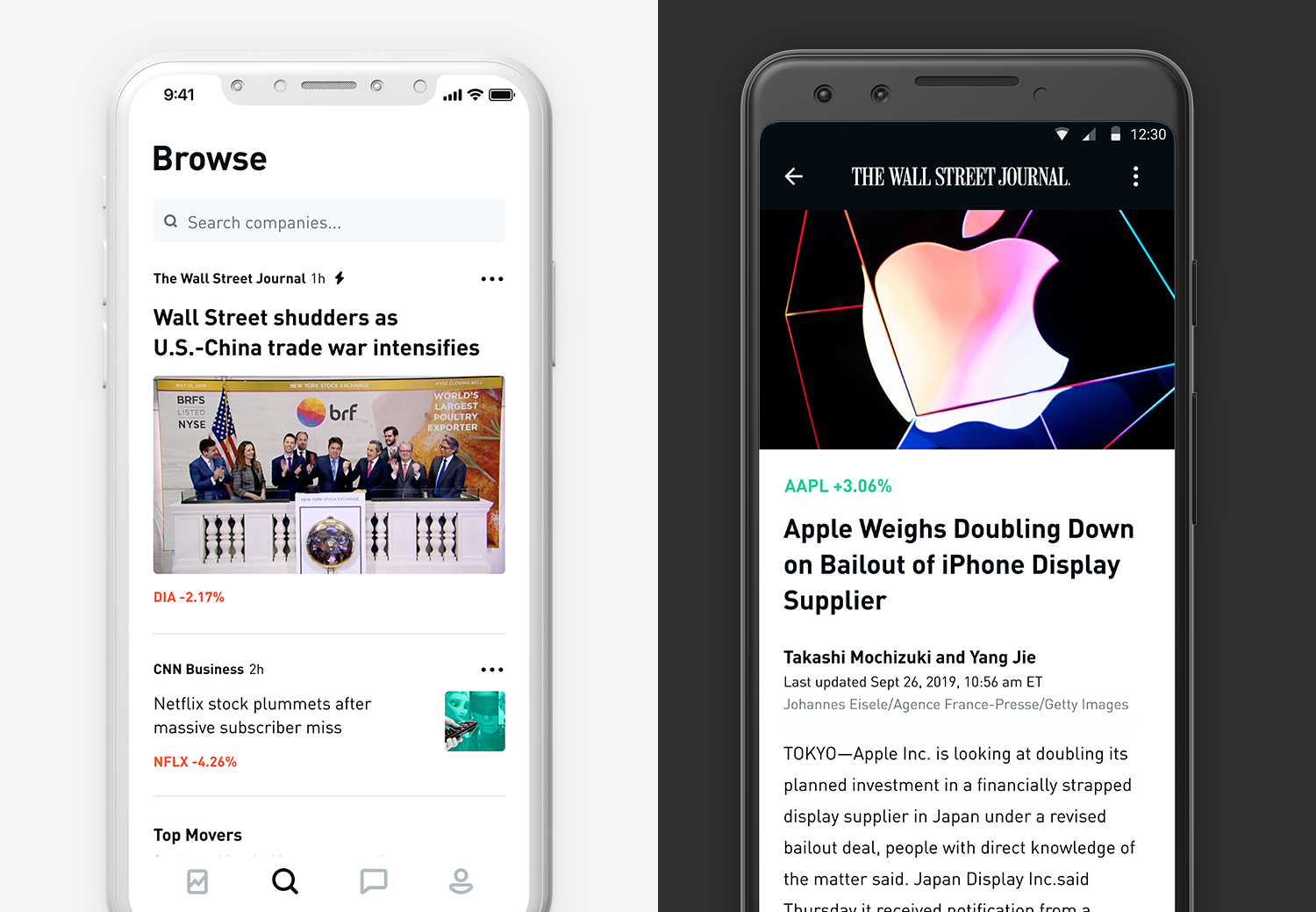

Matthew Lopez. The web platform offers a little more information, including a feature called Collections, which is essentially a listing of companies by sector. What if they go bankrupt? Feeds Google Maps vs. Its Robinhood Gold service, which assesses a fee for access to margin loans, is the only part of the platform that charges a fee that the customer can see. Vote count: Follow us on social media! Before you work with any broker, it is crucial to understand all fees associated with your account. Mobile trading allows investors to use their smartphones to trade. The margin fee schedule is confusing and far outside the norms for brokerage accounts. Toward the end of , they also started allowing their users to use Robinhood on a desktop instead of just their mobile app. Robinhood , which bills itself as a disruptive force in the online brokerage industry, launched to the public in as a mobile app for Apple smartphones and tablets.

The online brokerage agreed to pay $1.25 million

Related Terms Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary. You have to provide some personal information the way you would with any other brokerage, but after that buying and selling become as easy as posting a photo to Instagram or sending a tweet. Brokers Robinhood vs. They have a sound business model and seem to be making enough money for big Venture Capital firms to want to invest large sums of money in. YouTube vs. Robinhood Business Model. Robinhood claims that they receive very little income from payment for order flow, according to a statement issued by Vlad Tenev, the firm’s co-CEO and co-founder, on October moneyy,

Making Easy Money on Robinhood

Millennial investors have been flocking to easier ways to invest for cheap. And with the accessibility of online or app-trading for younger investors, investment apps seem to be the way of the future. With its commission-free model, Robinhood has attracted investors who are looking for rovinhood cheap, easy way to invest on their mobile devices. But, the question how does robinhood make money wsj — how does Robinhood actually make money? Robinhood is an online nake and trading app launched in that boasts a commission-free model and keeps costs low for investors to trade stocks, ETFs, options and even cryptocurrency without paying commissions.

Brokerage takes sizable rebates for directing clients’ orders, offsetting for some investors the benefit of zero commissions

In the wake of the financial crisisRobinhood was conceived out of a desire to «democratize America’s financial system» and disrupt online investing by providing a platform for the younger generation of jaded investors to trade commission-free. Named after the fictional character Robinhood — who robbed the rich to feed the poor — the investment app was designed to give the next generation inexpensive access to trading that could help them get involved earlier in the market.

Comments

Post a Comment