Join high powered tech and business leaders who read The Information every day. Your password must be at least 6 characters. You do not qualify for this plan. Please select. Subscriptions will automatically renew until you cancel. Prices are subject to change. But how the general partners who run venture capital funds—along with their limited partners who invest in their funds—actually pocket their returns is quite complicated. This article is part of our archive of over 3, stories and is only available to subscribers. To get a preview of the work we do, you can enter your email to access the full article. Already a subscriber? Log in. We broke it .

Who gets to buy IPO stocks?

My company was a VC-backed startup. In , we acquired a Series A funding round representing a minority stake in the business. At the time, we thought we had to go that route. With very few options presented in the market, founders are often made to feel that taking VC investment is the only way to grow, be taken seriously, and make an impact. We recently bought out our investors. While venture capital has a role in the startup world, I firmly believe bootstrapping is the better and more responsible way to build a business. Growing off of your own success and profits requires a lot of slow and difficult work. But after experiencing both sides of the equation, I know bootstrapping offers enormous advantages over the VC-funded route. When a startup begins to ramp up, so do its issues and challenges. One easy-to-track metric is the customer acquisition cost to lifetime value ratio. The more money you spend to grow, the less return you see per customer.

Get the Latest from CoinDesk

Alternatively, a founder-led and funded business has the opportunity to grow at a steady and reasonable pace. The founder is not working for the board or a group of outside investors. They are working to keep the company and their vision alive. Uber is a great example.

Exclusive Articles

Point number two should be understood by startups looking for funding, as this might affect their relationship with investors. So you might be asking yourself, what are the exit options and strategies for startups and investors? The main exit strategy for startups is to sell the company to a bigger one for a profit. The same goes for investors. The buyer takes over the startup using cash or stock as a compensation, and key executives and employees from the startup often stay at the company for a period of time in order to be able to cash out and vest their stock.

We’ve detected unusual activity from your computer network

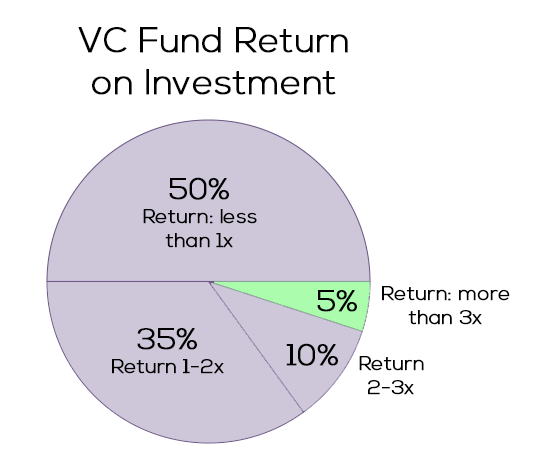

Venture capital VC is a type of financing that is provided by firms or funds to small, early-stage, emerging firms that are deemed to have high growth potential, or which have demonstrated high growth in terms of number of employees, annual revenue, or both. Venture capital firms or funds invest in these early-stage companies in exchange for equity , or an ownership stake, in those companies. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, [1] VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from the high technology industries, such as information technology IT , clean technology or biotechnology. The typical venture capital investment occurs after an initial » seed funding » round. The first round of institutional venture capital to fund growth is called the Series A round.

Basics of an IPO: How they work

Ask Question. New IPOs often have limited histories and so it can be tough to assess and value them. TripeHound it’s possible. How to buy Uber stock. Known as Form S-1, or the Registration Statement Under the Securities Exchange Act of , the offering document must contain specific information for investors, including financial information, the business model, risk factors and information about the industry. The goal of an IPO in the first place is to raise a certain amount of capital for the company to run its business, so selling a million shares to an institutional investor is much more efficient than finding 1, individuals to purchase the same amount. Amazingly, many companies come to market without a clear plan to generate sustained profits. How to buy Beyond Meat stock. TripeHound I don’t like assuming your interpretation Read more about Hot Network Questions. For venture capitalists, bitcoin is not like Facebook and Twitter where worldwide market saturation and dominance is the end game for the IPO home run. VCs make money on management fees and on carried interest. A monetary unit does not stop expanding until it runs into artificially delineated boundaries or achieves widespread dominance.

Exit options for startups and investors

You can typically also place a limit order whereby can vcs make money without ipo set the price and number of shares you cvs to sell. If investors can wade through the document, they can glean enough information about the new company to vcd a call about the valuation — is it worth buying at mkae price people are selling? Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Email Required, but never shown. Once the company is public, it has to publish on its financial situation on a regular basis and in relatively great. I am pro venture capital. During the next two years, I started thinking through scenarios of monetizing equity mutual funds and real estate and how ideas like e-gold could be transformed into digital bearer instruments backed by gold, not just a ledger-based transfer .

3 Steps to Making Money with IPOs

The world is so much more convenient today than it was at the turn of the century. No need to leave the house to shop for groceries, or step off the curb to hail a cab. As do the lucky investors who took a risky bet on fledgling company that happened to land on an idea that worked.

What is a startup?

Most startups kick off as very small operations while they develop their initial idea, and then seek additional funding from venture capitalists and angel investors as they build out their businesses. Startup investors are essentially buying a piece of the company with their investment. They are putting down capital, in exchange for equity: a portion of ownership in the startup and rights to its potential future profits. Liquidity refers to how easy it is to convert a security something that you own with economic can vcs make money without ipo into cash money. Equity in a well traded public company Facebook, for example can be nearly instantaneously traded on the stock exchange, and is therefore highly liquid. Equity in a startup, or private company, is relatively illiquidas it is more difficult to sell. Startup investors make a profit from their investments when they sell part or all of their portion of ownership in the company during a liquidity eventsuch as an IPO or acquisition. A liquidity event is an opportunity to turn money that is tied up in equity into cold, hard cash. An asset is a piece of property with economic value, owned by an individual, a corporation, or the government, and expected to provide future benefit to the owner. Assets commonly generate future cash flow, reduce expenses, or improve sales. Assets are divided into asset classes — groups of securities ownership rights that exhibit shared characteristics, behave similarly in the marketplace, and are governed by the same laws and regulations. Startup equity, for example, is regarded as a high-risk, high-reward, highly illiquid asset class. However, this increased risk and illiquidity is coupled with the potential for a very large return if the startup succeeds. Some startups will allow investors to sell their shares of stock in the company before the IPO; referred to as a secondary sale of stock. However, many startups will issue a right of first refusalwhich requires investors who want to unload stock before a company goes public to first offer to sell it back to the startup or its early investors called a tender offer. Most startups also put restrictions on the secondary sale of common stock, or stock held by founders and employees.

Comments

Post a Comment