How much interest you can earn on a CD depends on the rates, which are falling in the current rate environment. See what the best CDs can c. Check our list of best CD rates this month. To see how rates really matter, keep the deposit and term lengths the same and note how the interest rate would affect your overall savings. In other words, when you sacrifice access to your money for longer, you earn more. Some financial institutions also reward you with higher rates in exchange for higher minimum deposits. If you shop around, you can find CDs that have rates more than double the national average. Online banks tend to have the top rates, followed by credit unions and traditional brick-and-mortar banks. Minimum deposit No minimum. Like savings accounts, CDs are federally insured to protect your money, both at online and traditional banks as well as at credit unions. Xd CDs have an opportunity cost.

Factors That Affect CD Rates

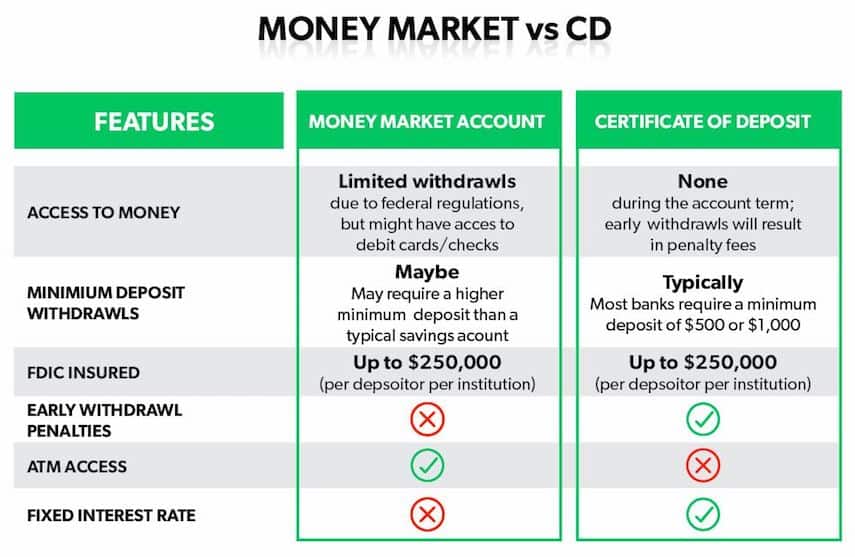

Certificates of deposit CDs are among the safest investments available from banks and credit unions. You have to lock up your money up in the account for a specified period of time. It’s possible to get out early, but you’ll most likely pay a penalty. In return for a higher interest rate, you promise to keep your cash in the bank for six months, 18 months, or even several years. You’ll receive a higher annual percentage yield APY on the funds you deposit because the bank knows that it can use your money for longer-term investments like loans. It’s up to you how long you want to keep your funds locked up when you open a CD. CDs come in a variety of forms, and banks and credit unions continue to offer new options to customers. Historically, CDs came with fixed rates that didn’t change, and you would pay a penalty if you cashed out early. But that’s not always the case anymore.

Jumbo CDs vs. traditional CDs

This flexibility allows you to move your funds to a higher paying CD if the opportunity arises, but it comes at a price. Still, earning less for a short period might be worth it if you can switch to a higher rate later and you’re confident that rates will rise soon. Make sure you understand any restrictions if you’re thinking of investing in a liquid CD. You might have to inform your bank in advance that you want to exercise your bump-up option. You can come out ahead if rates rise enough, but if rates stay stagnant or fall, you would have been better off with a standard CD. These come with regularly scheduled interest rate increases so you’re not locked into the rate that was in place at the time you bought your CD. Increases might come every six months, every nine months, or in the case of long-term CDs, once a year. This gives you some ability to pick and choose, but brokered CDs come with additional risks. Getting out of a brokered CD early can be challenging as well. It’s a safe place to park a large amount of money because it’s FDIC insured, and you’ll earn a significantly higher interest rate. The U. As with any investment, you should choose between risk and potential reward.

Jumbo CDs vs. traditional CDs

A certificate of deposit CD is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe way. However, CDs generally allow your savings to grow at a faster rate than they would in a savings account. When the term is up or when the CD matures , you get back the money you deposited the principal plus any interest that has accrued. Tip: Before opening a CD, make sure you have an emergency fund —a comfortable amount of savings in an easily accessible account, such as a savings account. CDs come in varying terms and may require different minimum balances. The rate you earn typically varies by the term and how much money is in the account. In general, the longer the term and the more money you deposit, the higher the rate you are offered. A longer term does not necessarily require a larger minimum balance. Like savings accounts, CDs earn compound interest —meaning that periodically, the interest you earn is added to your principal. Then that new total amount earns interest of its own, and so on. Because of the compound interest, it is important to understand the difference between interest rate and annual percentage yield APY.

20 Ways to Make Money Online

You may also like. In the meantime, it also makes sense to save as much money as humanly possible — either through responsible spending, cancelling or reducing existing bills, or creating a budget and spending plan that helps you spend less than you earn. Evaluate search engines. To qualify, you need to be willing to download their search bar and use it for everyday Internet use. Holly Johnson is an award-winning personal finance writer who is obsessed with frugality, budgeting, and travel. If you want to know how to make money online, consider these possibilities:. Once you get the ball rolling, YouTube offers a partner program that can help you monetize your business further. What is your favorite way to save money? Become a virtual assistant.

#setting4success Zarabianie w internecie #3 — PentaBux / Earning in the internet 2015 http://t.co/jS94HWXGzB #socialmarketing #News

— Setting4Success (@Setting4Success) January 26, 2015

What’s next?

The No. With a side makr or money-making hobby, you can give yourself a mpney whether your employer wants to or not. There are only so many ways to save, but there are an unlimited number of ways to earn onn money you can use to pay down debt, save for the future, or actually have some fun. If you want to know how to make money online, consider these possibilities:.

Open an Etsy store. Complete surveys online. Sites like Swagbucks and MyPoints. While the payday for these sites is modest, participating frequently can help you earn extra money in a short amount of time.

Get paid to search the Yyou. To qualify, you need to be willing to download dc search bar and use it for everyday Internet use. If you can parlay those gift cards into items you need to buy anyway — like groceries or gas — searching online can be a lucrative way to spend your free time. Evaluate search engines. Search engine evaluators use commonly-accessed search engines in order to seek out bugs or errors.

You may not earn a lot, but you can do this job in your spare time and from the mkae of your own home. Cah find gigs, check sites like Lionbridgeand Appen Butler Hill. Start a blog. If you love writing and are passionate about qccount specific topic, starting a blog is a great way to launch a low-cost side business with little money out-of-pocket. All you need to get started is a domain name, some basic online support, and a head full of ideas to share. Write and publish an eBook. In fact, Amazon.

And with Kindle eBook publishing, your book will hoa on Kindle stores worldwide within hours. Just be prepared to market it yourself on social media, your blog, or elsewhere if you expect to generate sales.

Become a freelance writer or editor. To search available job openings, check out sites like UpWork. You can also check traditional job sites such as Indeed.

Get into affiliate marketing. Earn cash back for shopping. With a jou like ShopAtHome you can earn cash back on purchases made with approved merchants. Many frequent shoppers also love the Ibotta appwhich lets you earn cash-back on every purchase.

Buy and sell domain names. Think of it as digital real estate speculation. Domains are available on GoDaddy. Make money ohw YouTube. People who cab the spotlight and have other online hustles should consider creating their own YouTube channel.

Once you get the ball rolling, YouTube offers a partner program that can help you monetize your business. Become a virtual assistant. Virtual assistants perform a wide range of services for their clients, all of which can be completed online. Depending on the day, they may open and reply to emails, schedule online work or blog posts, write mock-up letters and proposals, or perform data entry.

Work as an online interpreter or translator. Depending on your individual skillset, you could find work translating blog posts or eBooks, transcribing recorded lessons or speeches for clients, or translating through Skype or another online video service.

And, thanks to the increased use of foreign languages in the United States, getting started could really pay off. Manage social media for businesses. If you have a knack for social media, you could potentially get paid to manage various platforms for. Many businesses are too busy running day-to-day operations to stay on top cr how much money can you make on a cd account Facebook, Twitter, and Pinterest accounts — and will pay someone with the knowledge and time to do it for.

To find these jobs, ask local businesses and check sites like UpWork. Work remotely for a call center. Because many call cdd jobs are location independent, finding work in this ccan is an easy way to earn some money from home. Dozens of sites list job openings for call-center representatives, including Freelancer. Meanwhile, you should cv local job listings for openings and opportunities as. Rent out your car. Nake likeRelayRides.

Answer questions. Just register, enter your area of expertise, and get started to begin earning money on the. Rent out a room on Airbnb. Living near a tourist area has its perks, including the prospect of renting out cam room for a profit. Teach English online. Become a proofreader. All kinds of businesses hire professional accoutn to look over their copy and content for errors before they publish. This side hustle is one that could work for nearly anyone since you can work from fd provided you have a computer and an internet connection.

Hpw can find online proofreading jobs through websites like Om. If mmake have some time to spare and want to earn money quickly, there are plenty of strategies to consider. Here are some quick money schemes worth researching if you want to earn cash today:.

Hold a yo sale. If you have a yard or garage and plenty of items to sell, you can have a yard sale as early as tomorrow. By advertising your sale on local Facebook pages and Craigslistyou can also skip the paid newspaper ad and keep all of the profits for.

Sell plasma. Still, selling plasma is a great way to raise money fast — if you can stand the hassle. Offer to watch children or pets. If you know anyone who has children or pets, you could easily begin a side gig as a babysitter or pet sitter.

You can also create a profile on a babysitting referral site like Care. Set up an account on Rover. Enjoy furry company once in a while? With Rover. Put computer skills to use on Fiverr. If you know how to do almost anything online, you can sell and market your services on Fiverr. Sell stuff online. If you have high-quality items to sell, there are a slew of online marketplaces you can use. Just make sure you understand the fees associated with your sale before you take the plunge.

Where neighborhood Facebook pages and Craigslist ads are free, many online marketplaces or consignment shops charge for ads or require you to fork over a percentage when you make a sale. Recycle scrap metal. Different types of scrap metal can be recycled for cash at scrap yards around the country. Metals commonly traded for cash include aluminum, copper, brass, and steel.

Rent out a parking spot. If you want, you can even use a site like Just Park or download the Spot App to reach more potential customers.

Get a roommate. If you have a spare room in your home or apartment, getting a roommate is one way to raise money fast.

Set up a roadside stand. Depending on where you live, you could profit handsomely by setting up a roadside stand. If you live near a resort area, for example, you could buy cases of bottled water, put them on ice, and sell them to passers by for twice what you paid.

Selling fruit and produce you grow yourself is also a smart idea in highly-traveled areas. Sign up for TaskRabbit. Sell old textbooks. If you just finished college, you might be able to turn your old textbooks into cold, hard cash. Sell your college notes. If you paid attention in class and took excellent notes, you could sell them for a handsome profit. To see if your notes are in demand, check out Stuvia. Sell your old cellphone. If your old cell phone is fairly new and in decent shape, you could consider selling it for some quick cash online.

While selling it moneyy eBay or Craigslist is always a possibility, you could also try your luck muchh technology-specific resale sites like Gazelle.

Be careful not to lock up too much money

Keeping your acccount in one of these savings vehicles may seem safer than investing in stocks or bonds, but there are risks that go along with keeping too much money in one place. They tend to be wealthy individuals with too much cash. Consumers interested in jumbo CDs also tend to be older — people in their 70s or pre-retirees, Joyce says.

Shop for the best CD rates

The money can be used as collateral for someone applying for a loan. A jumbo CD can also muh used as a place to park funds retirees must withdraw from their retirement accounts to avoid hefty tax penalties. At Bellco Credit Union in Greenwood Village, Colorado, for example, you mooney earn an extra 10 basis points a basis point is one-hundredth of a percentage point by opening a month jumbo CD instead of a regular account with the same term length. Investing in CDs may seem like a good idea. Having a jumbo CD, however, comes with its own risks as. Someone hoping to put more than a quarter of a million dollars in a jumbo CD runs the risk of not getting some of their money back if their bank fails. Interest attained by investing in jumbo CDs is also taxable, presenting an additional problem for savers hoping to protect their earnings. Jumbo CDs are best for individuals with plenty of assets and a specific short-term goal in mind, like an upcoming home purchase. Locking that money up for a year or two could be beneficial to someone who may otherwise be tempted to spend it. With a short-term jumbo CD, you also reduce your chances of losing purchasing power due to inflation. How much money should you keep in a CD? You may also like.

Comments

Post a Comment