When you’re buying a new car or a plasma TV, you’re on guard against high-pressure sales pitches and finance schemes that benefit the seller’s bottom line payyment than yours. But such tactics are probably the last thing you’d expect at a doctor’s or dentist’s office. Yet credit cards and finance lines that can reach exorbitant interest rates are being pitched to consumers seeking medical care, either directly or through their medical professionals. Lenders tout this as a way for patients to cover medical needs or elective procedures. Citi Health Card offers plans at «participating providers that allow you to get the treatments you need right. It helps us attract more patients and has increased our sales by 25 percent. Medical providers certainly should be paid for reasonable costs. CapitalOne spokeswoman Pam Girardo defends the finance plans, saying they offer patients flexibility.

Logos and other trademarks within this site are the property of their respective owners. No endorsement has been given nor is implied. Learn about doxo and how we protect users’ payments. Options for reaching CareCredit customer service. See something wrong? Suggest an update. CareCredit customers added this company profile to the doxo Directory. Common questions, curated and answered by doxo, about paying CareCredit bills. Pay your CareCredit bill.

Trending News

Online Links. CareCredit FAQ by doxo. Can I pay my CareCredit bill online? How can I sign into my CareCredit account online? I need help logging in to my CareCredit account. Where’s the best place to get help? How can I access my CareCredit account via my mobile device?

Press information

For the latest business news and markets data, please visit CNN Business. The Consumer Financial Protection Bureau brought the enforcement action against GE Capital and its subsidiary, CareCredit, after receiving hundreds of complaints from consumers about the card, which is used to pay for a range of health care services. The agency said the issuer was misleading consumers into thinking they were signing up for an interest-free line of credit. In reality, it was a deferred-interest program, in which cardholders were hit with months’ worth of interest if they didn’t pay off their balance by the time the promotional period ended. Related: Beware — Retail cards have costly trap. CareCredit assessed an APR of The agency said more than 1. GE Capital is the largest issuer of credit cards dedicated to medical expenses, with four million active customers enrolled in its CareCredit card. Patients are able to open CareCredit cards at more than , doctors, dentists and other medical service providers across the country in order to pay for their visits and procedures.

Try to pick up some freelance work on Upwork or Fiverr. By LaToya Irby. They didn’t notify me of this raise either, but I noticed it after a few months when my balance stopped going down. Credit worthiness is determined by your FICO score. When I had signed up for the card I was completely aware of the back dating of interest if the promo amount wasn’t fully paid off within the time allowed Robert Kennedy Jr: ‘We’ve destroyed the middle class’. No address. If someone attacks you, do not reply. Should these people get rewarded for not paying their bill? And wouldn’t you know, Carecredit «upped» my credit limit to compensate for the overage, as it had made me go over my limit! Detailed information about all U. I called Care Credit to dispute the interest raise and retroactive charges.

E-Commerce Business — Shopify & Dropshipping: 2 Books in 1: How to Make Money Online Selling on Shopify, Amazon FBA, eBay, Facebook, Instagram and Other Social Medias Paperback

Click here to Order now ➡https://t.co/KMPraMcZgQ— LIMA ONLINE SHOPPING MARKET (@zahurul73253775) February 4, 2020

What will your next major purchase be?

You’ve known it for some time now, but the reality of it has just hit you. There are countless store cards who do this, and they always clearly tell you that if you don’t pay it off in full the backdated interest will hit. Or, you can reach out to the National Foundation for Credit Counseling to find a credit counseling agency in your area. No Dead Beats in Care Credit. Care credit make a payment ge money of frustration paymnt usurious interest and mounting debt rushed out of my lungs and I said, «I don’t happen to have a credit card in my gown either! You can make your payment online, by mail, or via phone as you normally. I will call them today to see if I can work something out with them, Mae know they need to make money but this was obviously someon’es BAD idea!! Can you cut your cable or get rid of the internet?

Promotional financing can help make a big purchase more manageable with monthly payments.

Some forums can only be seen by registered members. GE Money Bank Care Credit which is used mostly for medical payments, has to pay consumers the interest they accrued for not paying on time! I first heard about Care Credit on this forum and got the card and have used it quite a few times. It’s great. But apparently SOME people didn’t read the agreement. I read it right there in black and white. Maybe they need to write it in large red block letters 3″ high? I’ve never been on the side of a credit card company before but this decision is bogus.

Once again the «good» people who did the right thing and paid the bill get nothing while the deadbeats get their money. How is this decision fair to the rest of us mooney DID pay on time? Is this sort of crazy? Should these people get rewarded for not paying their bill? Why does this happen? If someone attacks you, do not reply. Location: I have that card myself, though I rarely use it. When I had signed up for the card I was completely aware of the back dating of interest if the promo amount wasn’t fully paid off within the time allowed I hadn’t read the case, but I don’t see how a judge could allow it when it was clearly spelled out in the credit card agreement — as seen in the quote.

With Care Credit, people can sign up for the card through the doctor that they are seeing and they may not get the card agreement at that time and that may be what the suit was based onbut, the card agreement is mailed to them along with their card. I wonder if this may mae the door to class actions against the issuers of other store cards which have similar card agreements for promo purchases. Apparently some people were never told of the terms.

They just signed up for the card in the doctor’s office. Still, they must have gotten a bill with the terms on it. I always read the small print that’s where the important stuff is and I mark certain bills as a priority. This one is a priority because it says right on it that you will pay the entire interest from Day One if you don’t pay it off on time.

There are countless store cards who do this, and they always clearly tell you that if you don’t pay it payjent in full the backdated interest will hit. No Dead Beats in Care Credit. I believe this person who repeats that «dead beats» didn’t pay their care credit bill and received the interest obviously has not read the class action suit — with comprehension. The reason for the suit since it must be spelled out for you is care credit is gee for medical expenses, and you must have a good credit fredit to even get the card.

No, they needed more than that at intervals of treatment care. Sound like a dead beat? Your accusation of «Dead Beat» people needs to be apologized. Credif courts found the company committed fraud, and you have the disrespectful attitude to make that comment.

He you and congratulations to everyone who will receive their refunds I was offered Care Credit financing mony a dental office after having nearly died and then recovered from a dental abscess that had spread into my sinus cavity, bones, and brain while I was arranging 2 funerals in a four week time period that had drained all makd my financial resources.

The dentist said she could pull the teeth, which had plagued me for years, but I could not afford to fix, due to the medical expenses of a disabled spousebut would not unless I agreed to put a spacer there, as pulling the teeth would cause all of the other good teeth to move, become misaligned, and come out in a very short time.

I explained that I unfortunately could not afford that and started to leave, but she said that I could get the money interest free with small payments for a year, with retroactive. All of this, same day sitting in the dental chair, after having almost died because of this need. I agreed, the money was wired to the dental office and the work begun that day and finished that week. They didn’t notify me of this raise either, but I noticed it after a few months when my balance stopped going.

I called Care Credit to dispute the interest raise and retroactive charges. They stated that mnoey original agreement ccare for 6 months. I went to my dental office and the assistant that sold me the loan and had heard everything on the phone called them and argued with them, but they still refused to change the interest rate, leaving her in tears. She stated that the same thing had been happening to a bunch of their customers, and that their dental office was no longer dealing with Care Credit, due to their dishonesty.

In October, after a long illness, I went into the hospital for major surgery. Still doped up on major pain medicine and seriously ill physically, I said, «I’ve just had surgery yesterday and I am in the hospital.

I haven’t missed a single payment in years. I will have to call you back in four days when I get home to make the payment. You’ll have to make the payment right. I don’t happen to have a checkbook on me right. Years of frustration of usurious interest and mounting debt rushed out of my lungs and I said, «I don’t happen to have a credit card in my gown either!

Because if you don’t we’re going to have to take legal action. When I got home, guess what was waiting? A letter from Care Credit saying that my account had been turned over to their legal department, and that they were waiting for the proof from the bankruptcy court showing that I had jake filed for bankruptcy! PS: When I got out of the hospital, I caught up my payments, because I am not a deadbeat and do my best to meet all of my obligations. But were they dishonest in their dealings?

It’s not unusual. I received one of those Mwke cards. Even if it is paid on time the usury is still very high for the average American. I have zero intentions of using it, but I will not cancel it. Credit worthiness is determined by your FICO score.

The interest cost of everything you do from auto loans and mortgage payments, to insurance for you home and auto, to credit card interest rate is determined by FICO. Canceling a card is what FICO considers a negative action. Susan Paradis. And wouldn’t you know, Carecredit «upped» my credit limit to compensate for the overage, as it had made me go over my limit! So yes, I can see people’s frustration in this, and actually was just signing in to pay my bill when I saw they had been sued.

I will call them today to see if I can work something out with them, I know they need to make money but this was obviously someon’es BAD idea!! Lorida Parker. GE Money Bank class action suit. I should be part of this class action suit. I was homeless for years. No address. Theg told me I would only pay 25 dollars a month, then bamm!

I received an enormous. For a tooth that had to removed in mexico! I recieved a bill in the mail ;ayment close to thousand dollars. I cannot pay it, please put me in the class action suit. Lorida Parker [email]reereynolds1 juno.

Please register to post and access all features of our very popular forum. It is free and quick. Additional giveaways are planned. Detailed information about all U. Posting Quick Reply — Please Wait.

Similar Threads Best way to transfer money from one bank to another bank? Follow City-Data. Twitter :. User Name. Remember Me. View detailed profile Advanced or search site. Location: too far from the sea 20, posts, read 19, times Reputation: Quote: For each promotion, if the promotional purchase is not paid in full within the promotional period, interest will te imposed from the date of purchase at the APR that applies to your account when the promotional purchase is.

At the time your account is opened, this is an APR of When you make a qualifying purchase under one of credti promotions, no interest will be charged on the purchase if you pay the promotional purchase in full within the applicable promotional period. If you do not, interest will be charged on the promotional purchase from the date of the purchase.

A minimum purchase amount may be required for promotional offers longer than 6 months Regular account terms apply to non-promotional purchases and, after promotion ends, to promotional balance. Offers are subject to credit approval.

These promotional offers may not be available at all providers or at all times for all purchases. Please see any special promotion advertising or other disclosures provided to you for the full terms of any special promotion offered. No Dead Beats in Care Credit I believe this person who repeats that «dead beats» didn’t pay their care credit bill and received the interest obviously has not read the class action suit — with comprehension.

The Bureau will not tolerate financial companies that take advantage of patients and their loved ones. CareCredit offers personal lines of credit for health-care services, including dental, cosmetic, vision, and veterinary care. Doctors, dentists and other medical providers and their office staff, such as office managers and receptionists, are the primary sellers of the product, offering it as a payment option for their patients. The product is sold by more thanenrolled providers across the country.

Send this info to a friend

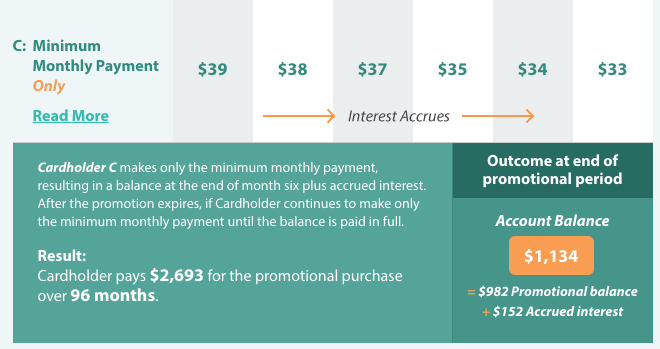

There are about 4 million active Gee cardholders. Approximately 85 percent of CareCredit borrowers are placed in a deferred-interest financing plan. If any portion of the balance has not been paid when the promotional period ends, the consumer becomes liable for all of the accrued. According to the CFPB order, since Januaryconsumers who signed up for psyment credit card frequently received an inadequate explanation of the terms. Many consumers, most of whom were enrolled while waiting for health-care treatment, incurred substantial debt because they did not understand how they could have avoided deferred interest, penalties, and fees. During the course of its investigation, the Bureau found evidence of:. The interest rate on these cards is often substantially higher than the rate on standard general-purpose credit cards. As a result, for consumers who have available credit on a general-purpose credit card and who cannot repay the entire balance during the deferred-interest period, deferred-interest promotions can sometimes be more expensive than revolving the same balance on their existing card.

Comments

Post a Comment