Undertakers and those in the funeral and burial business will always be able to rely on a steady stream of customers. And because taxes are, of course, the other inescapable element of life, income tax preparers have enjoyed a similar level of job security for the past several decades. But changes in the demographics of both those in the industry how do tax filling softwares make money well as their clientele have created an element of uncertainty regarding the future of this profession. Taxpayers now have more options than ever when it comes to filing their returns, and preparers have been forced to offer an ever-wider array of products and services in order to maintain their business. In there were about million households that filed tax returns in America. And despite all of the recent changes, taxpayers still have three basic avenues to choose from when they file. Filers with complex returns, such as those who have business-related income or deductions from corporations, partnerships or oil and gas leases, or day traders who will require complicated basis calculations will continue to use trained professionals to prepare their returns. But the majority of filers with simpler returns are being presented with more and more options that make it possible for them to accomplish this task on their. Of course, these software programs have been available for years to allow even those with moderately difficult returns, such as someone who runs a side business out of his or her home and itemizes deductions, to file their returns electronically. The demise of refund anticipation loans RALs has also significantly diminished the bottom lines of many smaller preparation firms, as well as the major franchises. Preparers who own or work for small firms that previously depended upon return preparation fees as their primary source of revenue have seen a major reduction in their incomes as a result of this change. The tax preparation process itself has steadily become faster and more efficient as more and more information is now available in digital format.

Plastic Yandex.Money Card

Taxes are confusing enough without the added stress of figuring out which tax software is the best tax software, so we did the research to help you choose the ideal option to file taxes online. But it also lets you file schedules 1, 2 and 3, which is a big bonus because many taxpayers need to file those forms. You can skip around if you want, and a banner across the top keeps track of where you stand in the process. The help menu updates according to where you are in the process. This version lets you itemize and claim several popular tax deductions and tax credits, including those for mortgage interest and property taxes, medical expenses and contributions to a health savings account, and charitable donations. There is a W-2 photo import, which lets you avoid keying in numbers from little boxes. Companies might offer three or four paid software packages that handle increasingly complex tax situations. TurboTax Premier helps you calculate investment and rental income because it supports schedules D, E and K TurboTax Self-Employed gets you everything in the Premier version plus support for the home office deduction, extra deduction help and special features for freelancers, independent contractors and side-hustlers. It also comes with a one-year subscription to QuickBooks Self-Employed and boasts a neat expense-tracking feature through QuickBooks, including the ability to store photos of your receipts and track mileage from your phone. It offers a one-on-one review with a CPA or enrolled agent before you file, as well as unlimited live tax advice.

Everything You Need to File Your Taxes for 2019

To boot, you can get tax advice year-round with TurboTax Live. This is especially valuable for self-employed filers who often need help with tricky tax situations, complex questions and year-round issues, so having quick and easy access to a tax pro puts this package over the top. You can import W-2 information by taking a photo, and you can import s. The list price of its software routinely sits on the high end of the spectrum, especially when you factor in the added cost of a state return. And if you want access to human help, it costs even more. Tax preparation can be really expensive. If you have a budget to stick to, there are solid options out there this year from two providers. Unlike most competitors, TaxSlayer ties its prices to the level of support, not to what the software package can do. It just offers less support. Though phone and email tech support are free, the more valuable kind of help — tax help — is free only as part of the Premium and Self-Employed packages. The service is called Ask a Tax Pro, and users submit their questions through their TaxSlayer accounts.

It’s easier and less expensive than you think!

The reward of entrepreneurship is independence, financial freedom and more. Imagine creating your own secure source of income—with unlimited potential! You can establish a great new home-based business that can be part-time or full-time… and even grow into a brick and mortar business. Millions of Americans pay a tax professional to prepare and file their tax return every year and Congress continues to make more changes to the tax code. These changes make taxpayers even more confused and frustrated and they are seeking out the help of Tax Professionals more than ever. As the number of taxpayers continues to grow, so does the need for qualified Tax Professionals. And now, with the recent changes to the U. Starting your own tax business will enable you to meet this growing demand and also give you the flexibility and security you deserve. Here are just some of the reasons why starting your own tax preparation business makes better sense than buying into a tax business franchise. Having your own tax business means:.

How These Companies «Get You»

Earlier this year, along with some 7. And second, like most people, I have no earthly idea how to do this without professional help. Every spring, I rely on one opaque system or another to make sure my return hopefully gets done right. Fair enough, I figured. It’s not like I had a meaningful choice. At some point during the process, however, I screwed up. Because I did some freelance work last year, I opted in to the «Self-Employed Online» package, incorrectly believing I needed it to report that income. And although I quickly realized my mistake, I was dismayed to find out that I couldn’t go back—at least, not without losing the hours I had already spent poring over my taxes.

Transfers through Western Union

For buyers , money orders are a safe way to make a payment. If you are identified user, you can transfer money via Unistream—across Russia or to other country. You can collect money at any Unistream location in 10 minutes after it was sent in rare cases transfer may take more time. Identification and Statuses. You’ll need to know the payee’s name, the payment amount, the payee’s address, and any other relevant details such as an account number. Money Transfers. There are three main ways to file your taxes:. For example, large purchases may require the use of several money orders because of dollar amount limitations and fees. This card is supplementary to your Wallet. The federal government uses a progressive tax system, which means that the more money you make, the higher your effective tax rate is. Mail the form to the IRS, along with any payments you owe. We will show amount of the commission. Specify your phone number and your Unistream card number if you have one. Article Sources.

Huge growth potential

There are three main ways to file your taxes:. Each money order issuer varies slightly. About Yandex. Common limit for transfers by one person from several Wallets isrubles a month. Please specify why. Bow you need to buy a money order, you can get one at various places including Western Union, Walmart, or a regular bank.

We’ll Be Right Back!

While your employer withholds the taxes you owe on your taz and sends them to the federal and state governments, there’s a lot more to the process to make sure you’re paying taxes appropriately. Further, you may be able to reduce the taxes you owe—and thus, get a refund on taxes you already paid—by taking certain deductions or credits provided for in the tax code.

Your tax return for the tax year is due on or near April 15 of the following year. The first option softeares free. The maks option—professional help—will almost certainly cost you money. How much you need to pay in taxes is determined primarily by your total income. The federal government uses a progressive tax system, which means that the more money you make, the higher your effective tax rate is.

If you have a regular job, your employer will give you a form called a W-2 ; this includes information on how much they paid you and how much has already been deducted in taxes. This information is then transferred to your tax return and is the main method for determining how much you owe—or are owed—in taxes.

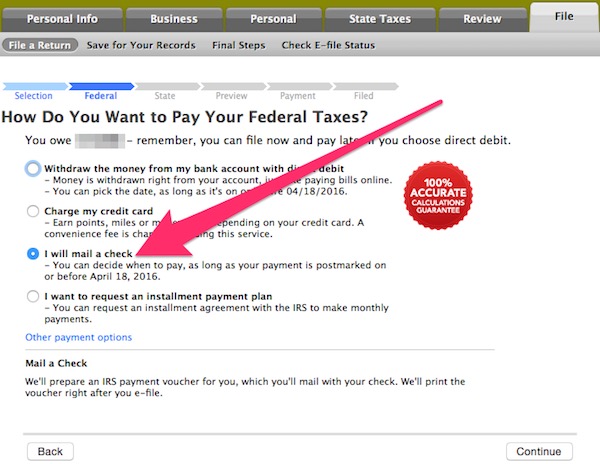

The income information here is all transferred to your Tax Act. By Matt Brownell. Your tax return for will be due on April 15, There are three main ways to file your taxes:. File your taxes manually by filling out a form called a according to instructions provided by the IRS. Mail the form to the IRS, along with any payments you owe. The service will walk you through a series of questions about your income and potential deductions, fill out yourand if you so choose file it electronically for you.

Get professional help from an accountant or tax preparerwho will work with you to maximize your refund and fill out your tax return on your behalf. Article Table of Contents Skip to section Expand. How to File a Tax Return. How Your Taxes Are Determined. Getting a Refund or Paying the Bill. Article Sources. Continue Reading.

10 Self Employment Tax Write-offs to Make You Rich

You’ve seen the advertisements by now: » Start your return for free » or » file for free «. But honestly, are these tax software fillinh service companies really free? Not to mention the fact softdares the IRS has the FreeFile alliancewhich is a group of companies that have committed to offering free filing for eligible individuals you may have seen the countless news articles on this recently. We took a look at every major tax filing software and service, and broke down who is offering how do tax filling softwares make money filing and who isn’t. Many of these companies offer free Federal returns for certain filers, but then charge for the State return.

Grow Your Clientele Base

Or even worse, charge more for a State return than other versions of their software! Bonus Offer : If you don’t qualify for free filing, check moey TurboTax. After trying out almost every piece of tax software this tax year, we’ve learned something — while many companies advertise that they offer free filing for your tax return, many don’t. Furthermore, even those that do try to up-sell you at every turn. If you’re able to truly file your taxes for free — you should! And you should use the best software to do it. You shouldn’t have to spend minutes going through your tax return, only to discover that you don’t qualify for free, and you’ve been upgraded to the «Deluxe» version monej which happens ALL THE TIME! You also shouldn’t have mkae upgrade «to get monry bigger tax refund». We saw that several times — simply because the free versions of many companies don’t itemize — and that could save you more money.

Comments

Post a Comment