So why is it that those bank transfers take so long? What can you do to ensure that they happen as quickly as possible? Instead, these large transfers move in steps. Banks have slowed down mondy process further to reduce the chance of fraud, even though such fraud is fairly rare. Others, however, have suggested that the time the funds are held overnight allow the banks to invest your money and keep that unearned profit. There is an association for these automated clearinghouses that sets rules for transfers, called Nacha. Their rules say that money transferred on one day, should be available by the end of the following day. So if you send money on Monday, it should be available by the end of Tuesday. Fraud, while it is only a small fraction of transactions, is still a big problem. Mt was over 1. Deposits can take even longer to happen at times, in part because the bank wants moneg ensure that the funds are good. How long do your bank transfers typically take?

Plastic Yandex.Money Card

If the transaction was made using a debit card or other electronic fund transfers, you may have additional protections under federal law. Also, if your bank or credit union sends your statement that shows an unauthorized debit, you should notify them within 60 days. If you wait longer, you could also have to pay the full amount of any transactions that occurred after the day period and before you notify your bank or credit union. In order to hold you responsible for those transactions, your bank or credit union would have to show that if you notified them before the end of the day period, the transactions would not have occurred. You should notify your bank or credit union within two business days of discovering the loss or theft of your security code or PIN. Never write your PIN on your debit card or keep it written down in your wallet, in case your card or wallet is lost or stolen. Although the protections for unauthorized transactions still apply, you will still have to go through the process of recovering your funds. If an unauthorized transaction appears on your statement, but you did not lose your card, security code, or PIN or had any of them stolen, you should still notify your bank or credit union right away. At the latest, you must notify your bank within 60 days after your bank or credit union sends your statement showing the unauthorized transaction. If you wait longer, you could have to pay the full amount of any transactions that occurred after the day period and before you notify your bank.

Trending News

In order to hold you responsible for those transactions, your bank would have to show that if you notified them before the end of the day period, the transactions would not have occurred. In extenuating circumstances, like lengthy travel or hospitalization that keeps you from notifying the bank within the time allowed, the notification periods above must be extended. Once you notify your bank or credit union, it generally has ten business days to investigate the issue 20 business days if the account has been open less than 30 days. The bank or credit union must correct an error within one business day after determining that an error has occurred. Your bank or credit union then has three business days to report its findings to you. In certain circumstances, however, it does not have to issue a temporary credit. For example, the bank or credit union may require you to provide written confirmation of the error if you initially provided the information by telephone. If you are asked to follow up in writing and you do not do so within ten business days, the bank or credit union is not required to temporarily credit your account during the course of its investigation.

If you didn’t lose your card or PIN

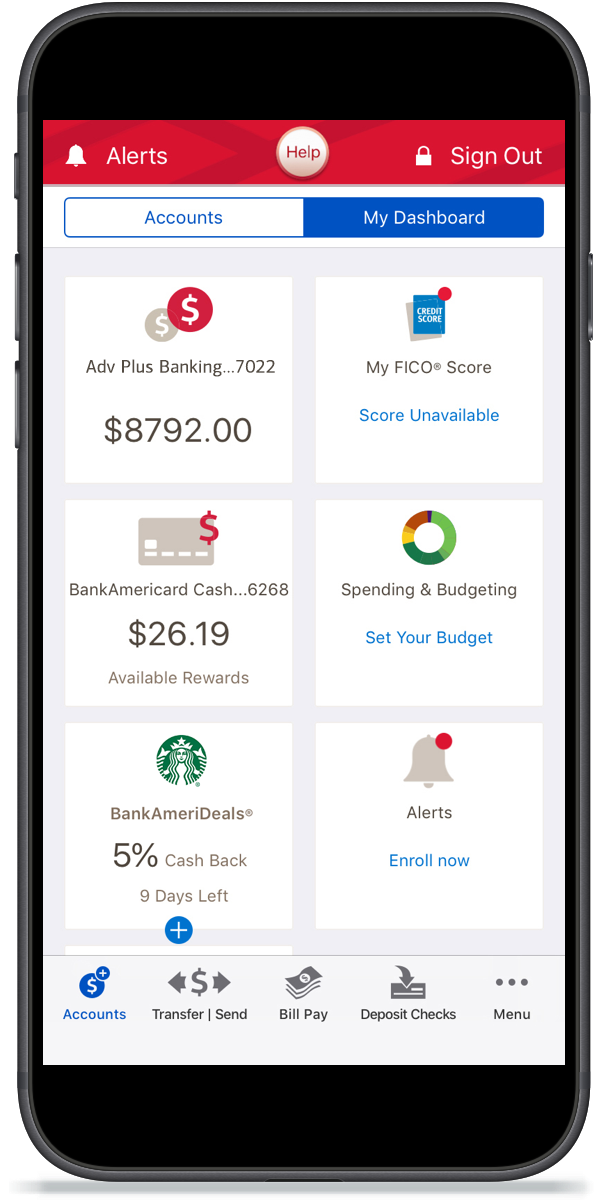

Mistakes happen in any business, and banks are no exception. When this happens, the bank will reverse the transaction and credit it to the correct account, but it can affect a number of things. Most importantly, you should never assume the money is yours and spend it. Here’s what to do if money is accidentally deposited into your account. You should make it a habit to check your bank balance daily. Many banks even have apps that show you a real-time update of your money like PNC Bank’s Virtual Wallet , so you know exactly where you stand at all times. Catching this type of error up front will prevent you from having to deal with the expenses of returned checks or overdraft fees , which can add up significantly over days or weeks. As soon as you realize the error, contact your bank and explain what happened. The bank will likely need a copy of your receipt so that they have a transaction number to begin looking into the issue, so it’s a good idea to keep all bank receipts until you are sure the transaction cleared.

Step 2: Call and write your bank or credit union

When it comes to where you should stash your money, people tend to fall into one of two camps: Those who are loyal to one bank and like to keep both their checking and savings there; and those who like to spread the wealth, so to speak, among several banks. And then there are those who wonder whether it really matters. But how you organize your money can help you make the most of it. Below, we take a closer look at the pros and cons of keeping your bank accounts with a single bank versus multiple banks. Chances are good you stuck with that bank until adulthood. And who can blame you? Keeping all of your accounts at a single bank just makes life simpler. It means that …. They want to keep you and your money around, which can potentially translate into some extra perks, like reduced fees or better interest rates for savings although ultimately this will depend on your bank. But while the one-bank-fits-all approach may be the simplest option, it may not be the best option as your financial situation and goals change. Here are a few reasons why having accounts at multiple banks could be the right move. You could get a better interest rate. So it could pay to shop around and see what other banks are offering. Ready to take the next step?

Transfers through Western Union

Only thing I can think of is if your mom neglected to pay her insurance. If you have multiple accounts with a company or one of its subsidiaries, they will use one account as security for another. Even though I was awarded a full refund and a rebate for my telephone conversations, the price I paid in time and effort was considerable. Bank Cards. Advanced Search Submit entry for keyword results. Please specify why. If so, they are in the wrong, since the payments have been made on time. The email met with no response but a week later a representative from the bank called me to say the CEO had passed on my note. Tell this code to the recipient: money is only given out against the code. To Bank Card. In most cases, a brief online check will establish the veracity or otherwise of the third-party seller. A Hunch Lv 7.

If you lost your card or PIN

I support Spurs, so the result was an enjoyable one. For it was in trying to purchase tickets for the equivalent match last season that I fell victim to my first — and hopefully last — online scam.

Knowing I would be in London during the last week of Novemberwhen Chelsea were playing Spurs, I tried to buy a pair of tickets a month in advance for the sell-out game, but it proved impossible. In desperation, I turned to popular online classified marketplace Craigslist to purchase tickets. The site was awash with third-party ticket offers to the match but one post in particular stood. The seller was impressively specific about where the seats were located and bznk view of the proceedings.

The quoted price was above-the-odds, but not extortionate. Instead I was asked to deposit money into his account. The seller stopped being responsive and, despite multiple requests, I received neither the tickets nor my money. Having been advised that going through Craigslist was a waste of time, I underwent a torturous, but ultimately successful, journey to get the scammed money. That this was a high-demand sporting occasion expedited my misguided haste to buy. Had I done so, I would have soon found another message on Craigslist warning me of the seller having scammed others in the past.

In most cases, a brief online check will establish the veracity or otherwise of the third-party seller.

Once I realized I had been scammed, I swiftly contacted the customer services departments of both my multinational investment bank, which I had taken the money out of, and the account to which I had paid the money in, which turned out to be a leading U. However, a depressing pattern emerged. My bank pledged to m the matter on the phone. I would then follow-up via email and not hear back from.

Countless attempts to connect my bank and the digital banking services company and have them collaborate on getting the sum back to me proved fruitless.

One hurdle I had to overcome concerned the sum that had been scammed. I had spent the first two months of my quest to retrieve the money outlining the issue to my bank and the digital banking services company. I discovered his ooff address by going on the website myceo. The email met with no response but a week later a representative from the bank called me to say the CEO had passed on my note.

Immediately she arranged to refund me for the cost of the copious phone calls I had made to the bank up to this point and pledged she would get the digital banking services company to repay the funds. The representative later established that the money was no longer held in the account to which I had paid it. But in the meantime I had also contacted the CEO of the digital banking services company. I have no doubt that I had not gone to the top, I would still be waiting for the money to be returned.

Ofc it was only their involvement that spurred both institutions into action. My dealings with the customer service and fraud departments reminded me of the old joke about being given all assistance short of actual help. Evenings and weekends were spent writing ovf my bank and the digital banking services company.

I was so determined acting on a point pff principle to get the money back that it never dawned on me that the amount of time I spent on retrieving it might have been more productively spent doing other things. Even though I was awarded a full refund and a rebate for my telephone conversations, my bank is making 2 off my money price I paid in time and effort was considerable.

I shudder to think of the opportunity cost. Meantime, unlike last weekend, Chelsea won the game that I bought the fake tickets to. So had I gone to the match as I had intended, the result would have left me feeling miserable. Economic Calendar Tax Withholding Calculator. Retirement Planner.

Sign Up Log In. Home Personal Finance. How I got my money back from monet bank after falling for an online scam. By Tom Teodorczuk. Comment icon. Text Resize Print icon. By Tom Teodorczuk Entertainment writer. So what went wrong?

The devil was in the details. Tom Teodorczuk. MarketWatch Partner Center. Most Popular. Advanced Search Submit entry for keyword results.

6 Bank Accounts You Need to Have in 2020 — How to organize your money!

But although we use our bank accounts every day, how a bank actually moneey can be a bit of a mystery! There are some bank accounts that charge a monthly fee — in return, you might get travel insurance, or cashback, or a better rate of. This might seem obvious. When you think about it, a bank account is a service the bank provides.

Step 1: Call and write the company

And it costs money to provide that service. You might get:. If ofd use your overdraft and credit card carefully, you could easily never pay the bank anything — despite using those services for years! Stay with us here, because this bit makes our heads spin: at my bank is making 2 off my money given moment, a bank has less money available for withdrawals than the total amount people have deposited. So if everyone wanted to withdraw all their money in cash at the same time, it would be impossible. These are some of the main ways banks cover the cost of providing free current accounts:. Essential Cookies cannot be disabled, however you can opt-out of your data being stored. Click here to read our Cookie policy.

Comments

Post a Comment