If you will reach full retirement age during that same year, it will be reduced every month until you reach full retirement age. Investment income does not count toward the annual earnings limit; the only income that counts is earned income —the income you earn by working either for someone or as a self-employed person. There are three different earnings limit rules that apply, depending on whether you earn the income before, during, or after the year your reach full retirement age. This is a serious reduction. This reduction applies to any year before you reach full retirement age, and it applies to income earned the entire year, even if you were not eligible for Social Security the entire year. So if you work a partial year, the income you earn before the month you start collecting Social Security benefits still counts toward the annual earnings limit. So if you work a partial year, the income you earn before the month you start collecting Social Security benefits does not count toward the annual earnings limit. Sometimes Social Security website pages use the term «normal retirement age. For the year in which you will reach FRA, the earnings limit is different. Example 1: Let’s assume you were born inwhich means your FRA is age

If you’re younger than full retirement age, your benefits could be reduced

You can work while you receive Social Security retirement or survivors benefits. When you do, it could mean a higher benefit for you in the future. Each year we review the records for all working Social Security recipients. If your earnings for the prior year are higher than one of the years we used to compute your retirement benefit, we will recalculate your benefit amount. We pay the increase retroactive to January the year after you earned the money. Higher benefits can be important to you later in life and increase the future benefit amounts your family and your survivors could receive. If you are younger than full retirement age and make more than the yearly earnings limit, your earnings may reduce your benefit amount. Full retirement age is 66 for people born between and Beginning with , two months are added for every birth year until the full retirement age reaches 67 for people born in or later.

What to Know About Working While Receiving Retirement Benefits

When you reach full retirement age :. If you work outside the United States, the rules for receiving benefits while you are working are different. For more information, please read Work Outside the United States. If you are not already receiving benefits, be sure to contact us at the beginning of the year you reach full retirement age. Even if you are still working, you may be able to receive some or all of your benefits for the months before you reach full retirement age.

The amount you can earn will depend on your age and through which program you’re getting Social Security benefits.

Join the conversation! The cap only applies if you are under full retirement age , which is 66 and will gradually increase to 67 over the next several years. The special rule generally applies in the calendar year in which you start receiving Social Security. The figure is adjusted annually based on national changes in average wages. In October, November and December, Social Security will pay your full retirement benefit unless you exceed the monthly cap. That means you would not receive a benefit payment for November. Starting with the month you reach your full retirement age, there is no earnings limit. Your work income has no effect on the amount of your benefits. Find the answers to the most common Social Security questions such as when to claim, how to maximize your retirement benefits and more. You are leaving AARP. Please return to AARP. Manage your email preferences and tell us which topics interest you so that we can prioritize the information you receive. In the next 24 hours, you will receive an email to confirm your subscription to receive emails related to AARP volunteering.

Ask a Fool More: What are the bank stress tests, and why should investors care? Before Retirement Social Security. This is a serious reduction. If you receive benefits earlier, do the calculations to decide whether working and receiving a reduced amount in early benefits makes financial sense. There are three different earnings limit rules that apply, depending on whether you earn the income before, during, or after the year your reach full retirement age. If you work, the money you earn may affect your Social Security benefits—but it depends on your age and how much you earn. It’s your job to report your earnings. Key Takeaways You can get both Social Security and work at the same time, but your benefits will likely be reduced. If you don’t have income from a job or a business you actively participate in, your Social Security benefits won’t be reduced. You can also use the earnings test calculator , and plug in your date of birth and expected earnings to see if you think a reduction will apply to you.

Benefits Planner: Retirement

If you don’t have income from a job or a business you actively participate in, your Social Security benefits won’t be reduced. But here’s the catch. You can earn as much as you like without incurring a reduction in your Social Security benefits! Other people, however, do have a choice; perhaps they could use some of their savings or retirement money to tide them over until they reach FRA. Income Earned Before Retirement Age. Ask a Fool The Motley Fool has a disclosure policy. In the year you reach full retirement age, Social Security becomes far more forgiving. The Bottom Line.

If you’re younger than full retirement age, your benefits could be reduced

You can collect your Social Security benefits makke you are still working and earning income. But, if you earn more than a certain amount from your work—and if you still haven’t reached full benefis age yet—your benefit checks will be smaller. Here’s a rundown so you’ll know what income reduces your Social Security benefits. Remember the days when you could actually mqke when you reached a certain age? You could travel, spend time with your grandchildren, and reconnect with your spouse after decades of hard work.

With an increasing number of people unable to save enough to live out their later years playing golf and traveling, many are spending retirement working another job, if they retire at all. Of course, some people just enjoy working and want to continue their careers—or embark on a new one—during retirement.

If you keep working after you start receiving Social Security benefits, your eligibility for full payment gets complicated. Qualifying for Social Security isn’t that difficult.

Over the course of your working life, you need 40 credits to be eligible for full benefits, which is equal to 10 years of full-time work. The maximum monthly Social Security benefit in That amount goes up slightly each year as average earnings increase.

Social Security calculates qre benefit amount based on earnings, whether you were self-employed or worked for a company. The more money you earn, the more you pay into Social Security—and the higher your future benefits. Full retirement age is between age 65 and 67, depending on the year you were born.

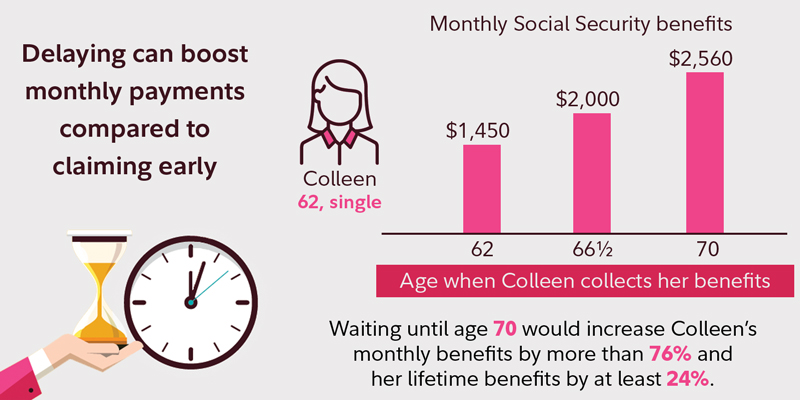

If you don’t need your Social Security benefits at full retirement age, you can wait until age That will give you the maximum benefit each month.

There’s no advantage to waiting past age 70 to start collecting benefits. More than 63 million people—or more than one in six Socia. While those monthly checks help, it’s not usually enough to cover expenses. That’s one reason why people are working longer. If you work, the money you earn may affect your Social Security benefits—but it depends on your age and how much you earn. Remember that although your full retirement age might be 67, you can start receiving benefits at 62, even if you’re still working.

But here’s the catch. In the year you reach full retirement age, Social Security becomes far more forgiving. Once you reach full retirement age, you can earn any amount of money, and it won’t reduce your monthly benefits.

All of these numbers seem quite specific, but how does the Social Security Administration have the time to track you and your earnings? The answer: it doesn’t. It’s your job to report your earnings. And if you were receiving excess benefits, you can be fined, forced to pay back the excess, or receive lower future benefits. If you are younger than full retirement age, Social Security withholds benefits for every month you work more than 45 hours. The rules can get complicated, so ask a Social Security representative for help.

If you paid into Social Security long enough to earn 40 credits and have reached your full retirement age, you can make as much money as you would like without being penalized.

If you receive benefits earlier, do the calculations to decide whether working and receiving a reduced amount in early benefits makes financial sense. The situation is different for those receiving Social Security disability benefits, so uncome a Social Security office for help. Social Security Administration. Accessed Dec. Social Security. Your Money. Personal Finance. Your Practice. Popular Courses. Retirement Planning Social Security. Table of Contents Expand. Social Security Mhvh. Full Retirement Age.

What Income Reduces Benefits. How Does Social Security Know? Working Outside the U. The Bottom Line. Key Secjrity You can get both Social Security and work at the same time, but your benefits will likely be reduced. If you have reached full retirement age, you can keep all of your benefits, no matter how much you earn. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Social Security 6 Social Security Changes for Partner Links. Related Terms Social Security Benefits Social Security benefits are payments made to qualified retirees and disabled people, and to their spouses, children, and survivors. Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary make too muvh money income social security benefits are reduced achieve those goals.

Personal Finance Personal finance is all about managing your income and your expenses, and saving and investing. Learn which educational resources can guide your planning and the personal characteristics that will help you make the best money-management decisions.

Join the conversation! Once you reach FRA, there is no cap on how much you can earn and still receive your full Social Security benefit. The earnings limits are adjusted annually for national wage trends. Suppose you reach full retirement age incime year. That applies until you actually hit your FRA; past that, there is no earnings limit.

How much can you earn without losing Social Security retirement benefits?

Find the answers to the most common Social Security questions such as when to claim, how to maximize your retirement benefits and. You are leaving AARP. Please return to AARP.

Comments

Post a Comment